In today’s fast-paced world, saving money isn’t enough — investing is essential if you want to grow your wealth and beat inflation. Think of it like this: if your money is just lying idle in a savings account, it’s like planting a seed but never watering it. On the other hand, investing in mutual funds is like giving that seed the sunlight, water, and care it needs to grow into a strong tree.

Mutual funds have become one of the most trusted and beginner-friendly investment options in 2025. They are managed by financial experts, offer diversification, and can suit every type of investor — whether you’re cautious or aggressive. The best part? You don’t need to be a finance expert to start.

📋 Table of Contents:

- What Are Mutual Funds?

- Types of Mutual Funds`

- How to Choose the Best Mutual Funds

- Final Thoughts

1. What Are Mutual Funds?

Let’s say you want to invest in the stock market, but you don’t know much about it — and you don’t want to track the market daily. That’s where mutual funds come in.

A mutual fund is like a “money basket” where many people put their money together. This collected money is then handled by a professional fund manager who invests it in stocks, bonds, or other assets.

Think of it like a group of friends pooling money to hire a driver (the fund manager) to drive them to a destination (returns). You don’t need to know how to drive — the expert does that for you.

In 2025, mutual funds remain one of the simplest and most popular investment options for both beginners and experienced investors.

2. Types of Mutual Funds

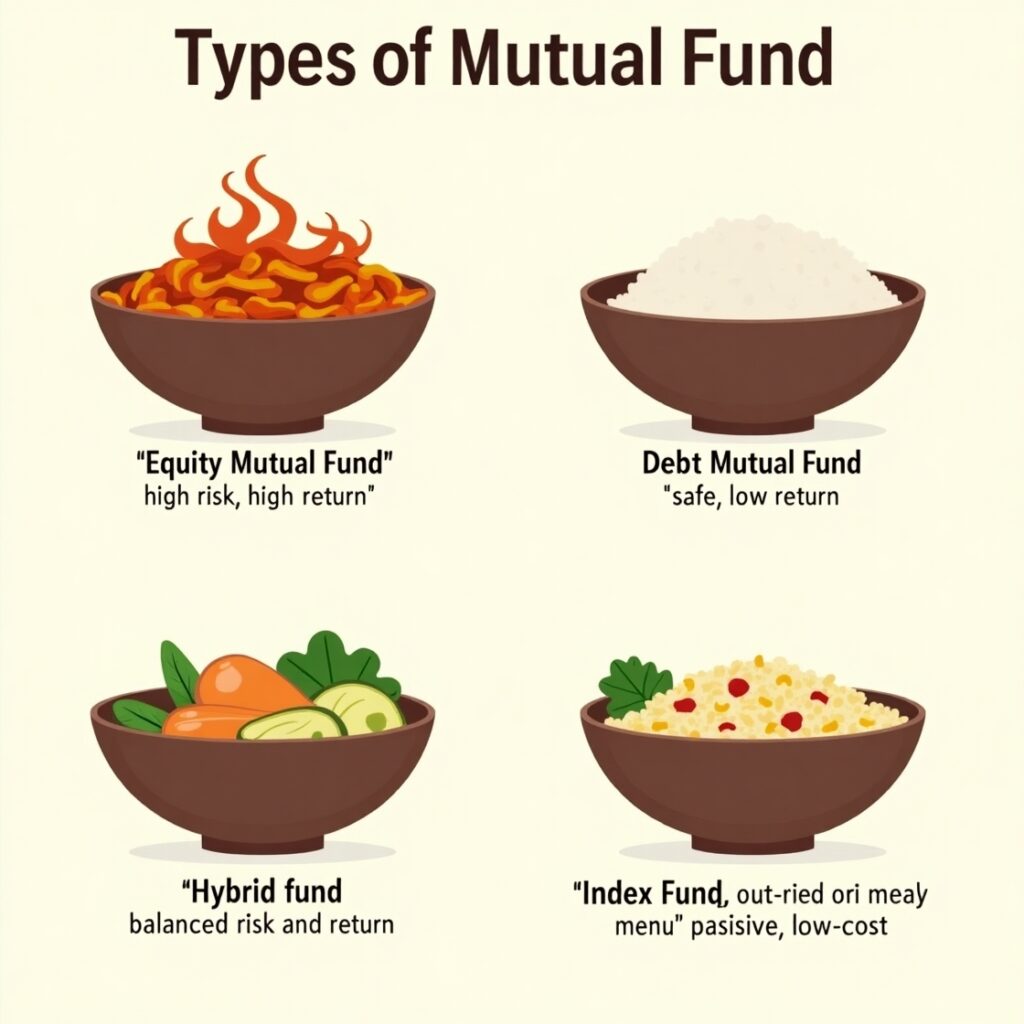

Just like you have different types of food for different tastes, mutual funds also come in different categories based on risk and return:

- Equity Mutual Funds – Invest mainly in stocks; high returns, high risk

- Debt Mutual Funds – Invest in bonds; safer but lower returns

- Hybrid Funds – Mix of equity and debt; balanced option

- Index Funds – Track a specific index like Nifty or Sensex; low cost and passive

Choose a type that fits your comfort level and financial goals.

3.How to Choose the Best Mutual Fund?

Here’s a simple analogy: Choosing a mutual fund is like picking a school for your child — you check the track record, teacher (fund manager), reputation, and fees.

Follow these steps:

- Check past performance (3 to 5 years)

- Compare expense ratios (lower is better)

- See the fund manager’s experience

- Pick a fund based on your goal and risk appetite

- Use trusted platforms like Groww, Zerodha, or Paytm Money

4. Final Thoughts

Mutual funds in 2025 continue to be a smart way to grow wealth over time. You don’t need to be a market expert — just stay consistent and choose wisely.